Looking to level up your trading career? Prop trading firms in 2025 offer traders the chance to trade large capital without risking their own money. In this guide, you’ll learn what prop firms are, the benefits they offer, and what it takes to become a funded trader. Whether you’re just starting or already a pro, this is your one-stop guide to the best proprietary trading firms this year.

What Is a Prop Trading Firm?

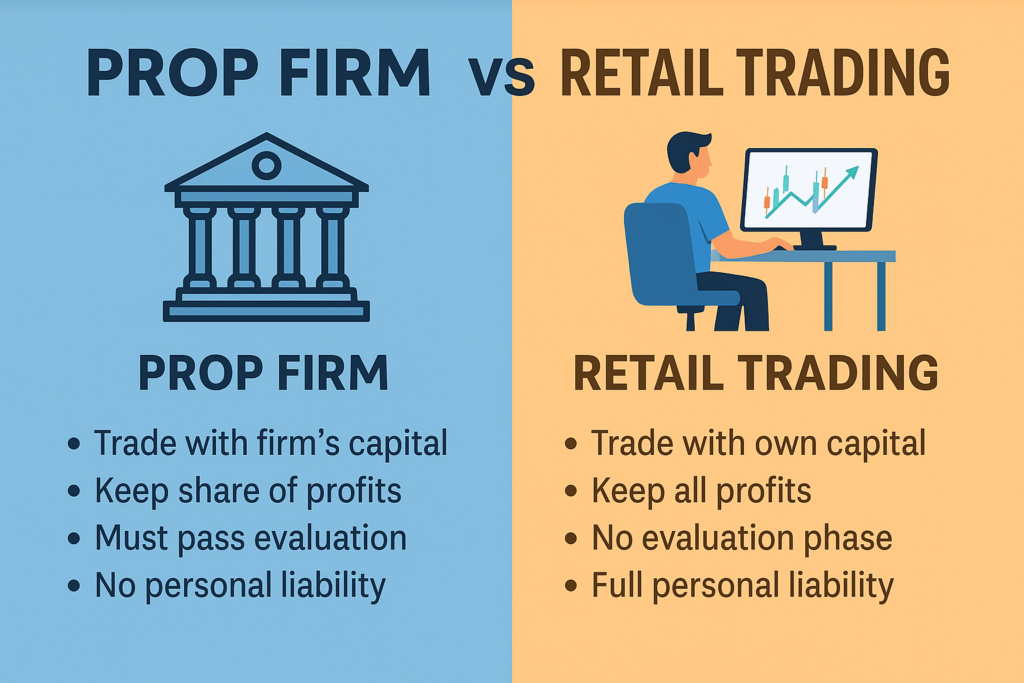

A proprietary trading firm (or prop firm) gives you the opportunity to trade the financial markets using the company’s capital. Instead of trading your own funds, you join a firm, pass a qualification challenge, and get access to a funded account.

These firms make money by taking a share of your profits, often letting you keep 70–90% of earnings. This model is perfect for traders who are confident in their skills but lack access to significant capital.

Benefits of Prop Trading Firms

Joining a prop trading firm comes with several strong advantages:

- Zero capital risk: You use the firm’s money

- Low entry cost: Challenges often start from just €50-€200

- High profit share: Up to 90% payouts on your successful trades

- Professional conditions: Trade CFDs, forex, futures, and stocks

- Scaling opportunities: Get access to higher capital as you prove yourself

This structure is ideal for disciplined traders aiming for growth without the fear of losing their savings.

Skills and Knowledge Required

You don’t need to be a hedge fund manager to start with a prop firm, but a few essentials go a long way:

- Strong risk management

- Understanding of market structure (especially forex or CFD)

- Comfort with challenge rules (daily loss, max drawdown, etc.)

- Discipline and consistency

📊 Funded Account Calculator

Choose your target capital and discover your trading potential

💰 What’s Your Investment Budget?

Enter your available capital to see which accounts you qualify for

Powered by BetonShares.com

Top 10 Prop Trading Firms to Consider in 2025

These are the most reputable and popular proprietary trading firms right now:

- FTMO – Challenge from €155, capital up to $400,000, 90% payouts

- The5ers – Instant funding model, risk-managed accounts

- MyForexFunds – Affordable plans, large community

- E8 Funding – Fast evaluation, great UI

- FundedNext – Great for forex and crypto

- BluFX – Subscription-based, no challenge model

- True Forex Funds – Fast payouts, tight spreads

- TopStep – Best for futures traders

- Lux Trading Firm – Swing and long-term friendly

- Leeloo Trading – Known in the futures market

Each of these has unique pros, trading styles, and evaluation processes. Make sure to compare based on what assets you want to trade (forex, CFD, futures) and how strict you want the rules to be.

Getting Started with a Funded Account

Most prop firms require passing a simulated trading challenge. Here’s what to expect:

- Phase 1: Prove profitability without breaching loss limits

- Phase 2: Maintain performance with lower targets

- Funded: Start live trading with up to $200K-$400K capital

FTMO

- Zero commission trades

- Real-time market data

- AI-powered analytics

- Limited crypto options

- Requires $500 minimum deposit

*Terms & conditions apply. Trading involves risk. Past performance does not guarantee future results.

What to Watch Out for in FTMO Prop Trading Challenges

Starting an FTMO prop trading challenge? Stay sharp! ✅ Always track your daily loss limit, understand the maximum drawdown rule, and trade with a tested risk management strategy. Avoid over-leveraging and make sure your trading plan fits FTMO’s evaluation criteria. Use proper lot sizes, stay consistent, and never gamble. Many fail by chasing trades or ignoring the FTMO rules. Study their swing vs. normal account types, and practice on MT5 or MT4 before starting. 💡 Want to pass FTMO? Focus on discipline, consistency, and smart execution—not fast profits.

Daily loss limit

The max you can lose in one day on FTMO. If you hit this, you fail the challenge—even if you’re profitable overall. Stay within limits to avoid instant disqualification.

Maximum drawdown rule

This is the total loss your account can take from the peak balance. It’s often a fixed value (e.g., 10%). Violating this ends the challenge, even with active trades.

Risk management strategy

A plan to control how much you risk per trade. Good traders risk 0.5–2% per position. This avoids blowing the account and keeps emotions under control.

Trading plan

Your blueprint for when to enter, exit, and manage trades. A solid trading plan includes risk rules, strategy, timing, and setups that align with FTMO’s goals.

Evaluation criteria

FTMO’s challenge rules you must pass: hit profit targets, stay within loss limits, and follow their trading rules—like holding over weekends or using EAs.

Lot sizes

The size of your trade position. Picking the right lot size affects your risk. Too large, and you risk breaching limits; too small, and you may not hit profit targets.

FTMO rules

FTMO has strict rules: max daily loss, max drawdown, no news trading (on some accounts), and minimum trading days. Breaking rules results in challenge failure.

Swing vs. normal account types

Swing accounts let you hold trades overnight and over weekends. Normal accounts restrict this but offer lower spreads. Choose based on your trading style.

MT5 or MT4

These are trading platforms you use with FTMO. MT4 is simpler; MT5 has more tools. Know your platform well to set stop-loss, take-profit, and trade efficiently.

Discipline

Following your strategy without emotions. Avoid revenge trading or overtrading. Consistent behavior under pressure is what separates pros from amateurs.

Consistency

FTMO looks for consistent profits over time—not just one lucky trade. Show stable, risk-controlled performance across many trades and days.

Smart execution

Enter and exit trades with precision. Avoid late entries, slippage, or panic closures. Good execution includes timing, order types, and controlled decisions.